ON SOLANA

We are committed to maintaining a regular schedule for distributing rewards to all liquidity providers. This ensures consistent and predictable incentives for participation in our liquidity pools.

• Rewards are distributed every 7 days.

• LP providers will receive additional rewards based on their positions.

• The regular reward schedule provides ongoing support to the project and to the community.

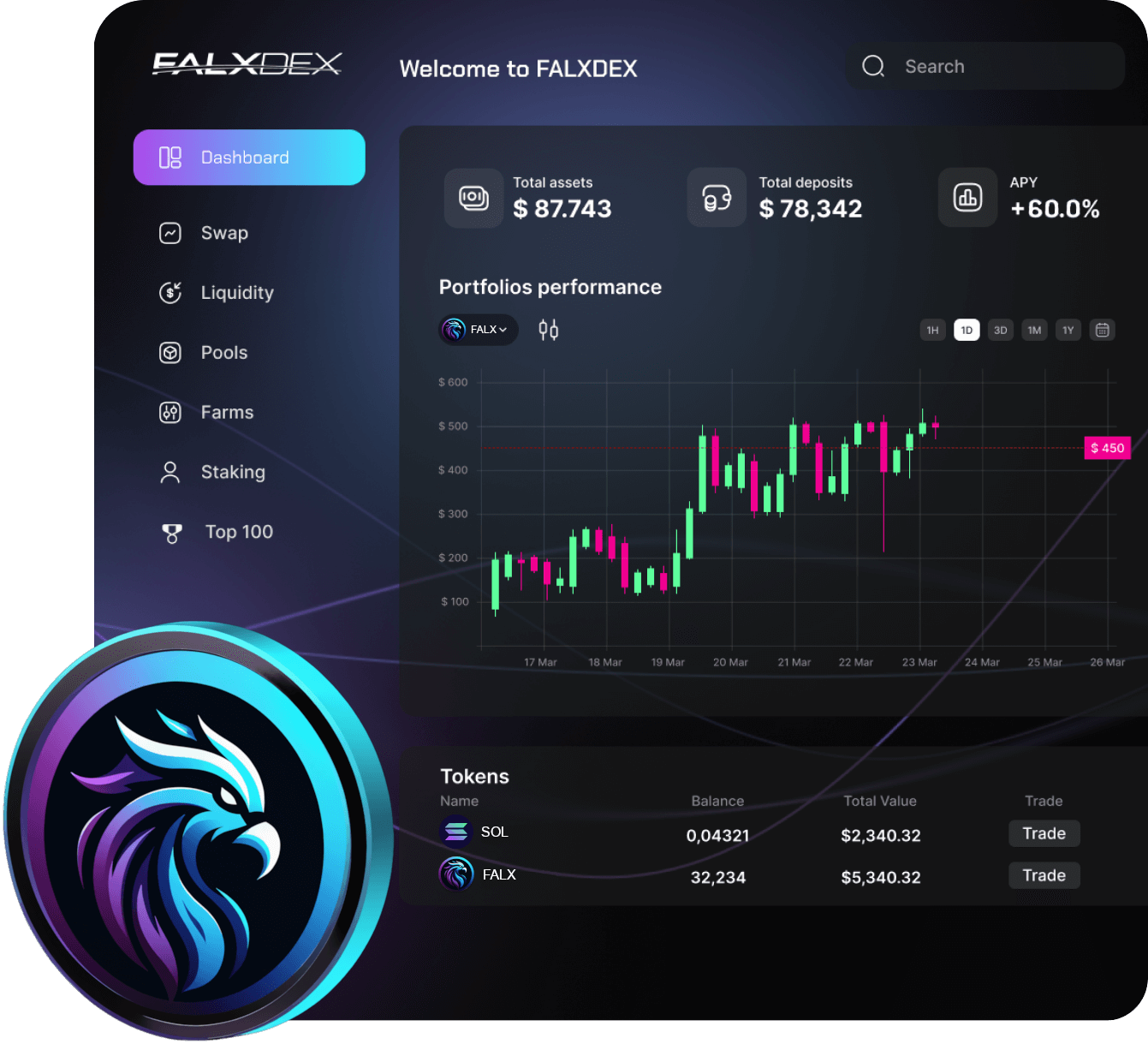

Our strategic shift to focus on liquidity pools will drive sustainable growth as a Decentralized Exchange (DEX). By concentrating on our liquidity pools, we aim to collect trading fees and distribute them based on provider positions.

• Staking rewards will continue to be distributed but will be gradually phased out in favor of LP rewards.

• LPs provide dual benefits: pool fees and token rewards.

• LPs will be integral to our upcoming FALXPAD and other utilities.

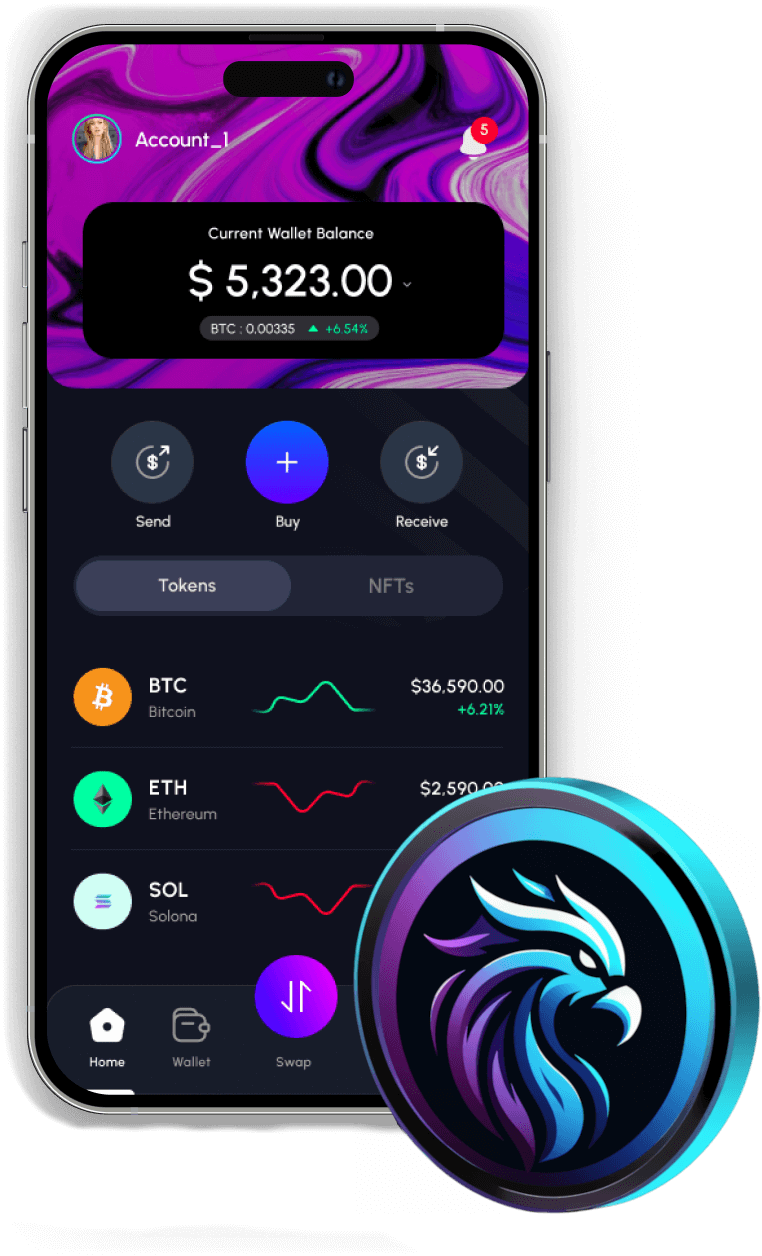

Our liquidity pools are offering FALX rewards to participants. This includes pools for FALX-SOL, DOPA-SOL, SOL-USDC and many others. Investors can view real-time APR stats and their positions on the dashboard.

• Participate in any of the LPs to earn rewards.

• Receive pool trading fees in addition to the token rewards.

• The dashboard reflects important stats about your LP portfolio.

The SolidProof team has meticulously tested and verified our code for "FALX LP Yields" to ensure its safety, efficiency, and readiness for production. The audit confirmed zero issues and declared it production-worthy.

• The contract is not upgradable and has been renounced to ensure its functions remain consistent and safe for investors.

• The audit confirms that the contract rewards current LP providers with a weekly FALX distribution.

☑ Project ownership verified

☑ List of all team members

☑ Team identity is verified with random requirements

☑ Contract is published on mainnet

☑ Project Name: FalXDex

☑ Project Website: https://falxdex.com

☑ KYC Issued: May 3, 2024